Vehicle mileage depreciation calculator

Conceptually depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. We will even custom tailor the results based upon just a few of.

Car Depreciation Calculator Calculate Straightline Reducing Balance Automobile Depreciation Rates Vehicle Values

Work-related car expenses calculator.

. This calculator is for illustrative and educational purposes. Seek independent financial advice. Calculations are for guidance only.

The car depreciation rate depends on the age of the car its mileage and the below depreciation table. Car Depreciation Calculator Enter your model data to get a custom graph and table based on model year and mileage driven. Car Depreciation Per Mile The average car can depreciate as much of 008 per mile according to some sources.

If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits. If instead you use the standard mileage rate 56 cents per business mile driven for 2021 a depreciation allowance is built into the rate. Average monthly Depreciation.

If you are in need of advice about your money and you live in the. The total of what you pay for fuel maintenance repairs your loan insurance and state registration fees is your operating cost. Select a Vehicle MakeManufacturer.

Dont count the miles you spend. You can then calculate the depreciation at any stage of your ownership. Using the Car Depreciation calculator To use the calculator simply enter the purchase price of the car and the age at which the car was when it was purchased by you 0 for brand new 1 for 1.

Car Age 1 year 2 years. Adding in depreciation gives you your real long. Your mileage write-off would be 3025.

If you use the actual expense method to. So if you purchased a car for 30000 and you want to know how much your new car will depreciate after five years here is how you would calculate the value based on the above. Find the depreciation of your car by selecting your make and model.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical charitable business or moving. It can be used for the 201314 to. 2500 x 0585 146250 and 2500 x 0625 156250.

510 Business Use of Car. Car Depreciation Calculator This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Select Make Input For Estimated Current Value USD 1.

For instance a widget-making machine is said to depreciate. Use our car depreciation calculator to estimate how much your vehicle could decrease in value each year over the next six years. This means of course that your depreciation costs will be.

Car Age 2 years 3 years. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade.

The calculator also estimates the first year and. Adding them together gives you 3025.

The True Cost Of Car Ownership The Best Interest

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Car Depreciation Online Tool For Philippines Carsurvey

Car Depreciation Calculator

What Mileage Does A Car S Value Depreciate Direct Car Buying

The True Cost Of Car Ownership The Best Interest

Mileage Cost Calculator For Real Estate Photographers

Research Which Cars Suffer From Depreciation The Most

Research Which Cars Suffer From Depreciation The Most

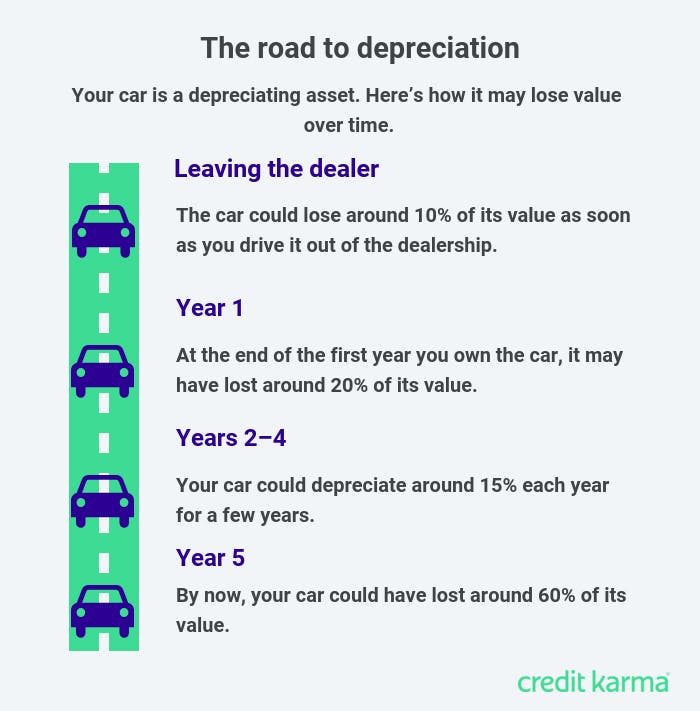

How Car Depreciation Affects Your Vehicle S Value Credit Karma

How Car Buy Rater Works The Methods It Uses To Evaluate Cars

Depreciation What Does It Mean For Your Vehicle

Mileage Reimbursement Calculator

Car Depreciation Calculator Calculate Depreciation Of A Car Or Other Vehicle

Car Depreciation How Much Value Have You Lost Masterpole Murphy Insurance Agency Syracuse Ny Independent Auto Home Life Business Insurance Agent

Use Our Rate Calculator To Budget For Mileage Reimbursement Costs

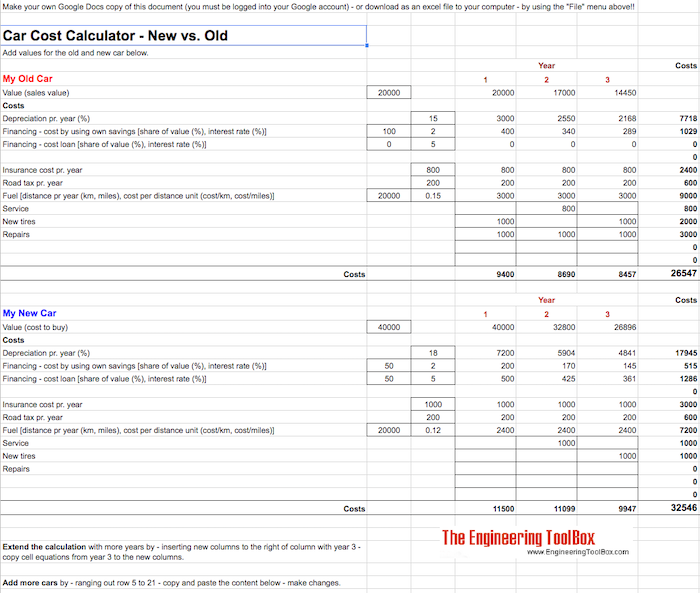

Cars New Vs Old Car Cost Calculator